Welp, let’s face facts: we’re in a recession. Sure, the markets are pretty much where they were before the Great Stay At Home Order of 2020, but let’s be real: it’s all artificially-propped up. It shouldn’t be where it is, what with unemployment at record highs and businesses closing left and right.

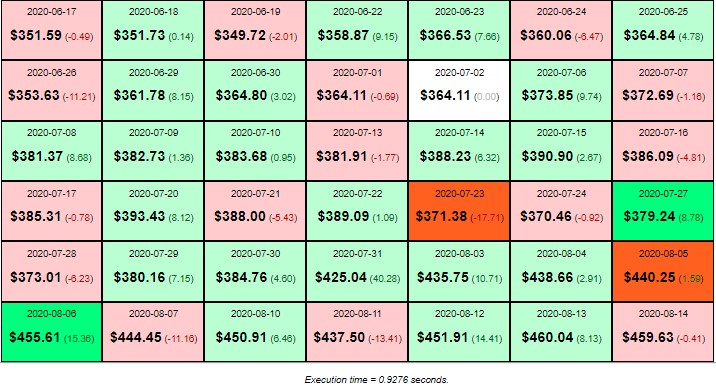

So obviously… I figured this would be a good time to get back into my stock market program.

I have been working on this program on and off for years (you can read a little bit about it here and here). This time there was both a little more motivation behind it and a little more time, as day work has been drastically pulled back (still employed but working about 25% as much as before). Figuring a “bottomed out” stock market might be filled with opportunity, I decided to go back to work on my program; however, since I last worked on it, hard drives have gone bad, files have been misplaced, etc. So starting from scratch once again was the only option.

Although this time I got it up and running pretty quickly, since I’d done it twice before already. I think the real feat is how quickly I’d done it given my complete lack of practice with PHP over the past 2-3 years. Yes, I’m doing it in PHP LOL … it’s the only language I know. I’m fully aware there are other faster, more suitable programming languages for this kind of stuff (Python, R, etc.), but I really, really don’t like learning new computer languages because it just never ends. They get updated, things get deprecated, it does not end. So I’m sticking with what I know, and that’s that.

I’ll get into more technical aspects of my program in future blog posts, but for now I’ll leave you with some insights I’ve had while coding and gathering data.

- The OVERWHELMING majority of the American Exchange isn’t even companies, it’s funds. At least 80% of AMEX is funds, maybe closer to 90%.

- A large portion of NASDAQ seems to be health care companies, much to my surprise, as I thought it would be tech companies. I’d say like 40% of NASDAQ is health care, but the close runner up is financials, which also include funds.

- I’m still going through NYSE, but so far it seems pretty diversified. Not nearly as many funds as NASDAQ or AMEX, the handful of derivatives I’ve come across are mostly notes or warrants for companies (whereas almost all the funds in AMEX have no company affiliation other than the company that set them up).

- I believe all these funds are part of the reason why the stock market “overreacts” to events. If a large company, like Google or Netflix, goes up or down, it takes quite a big portion of the market with it because those stocks affect the funds that they’re in, and those funds in turn affect other stocks that they themselves contain. Not to the same degree, mind you; I’m thinking probably like if Google goes up 10%, tech funds might go up 1%, which in turn drives the whole market up 0.1% (just a hypothetical example).

- To make matters worse, there are a ton of “duplicate” funds. Most of the big financial players (Schwab, JP Morgan, etc.) have sector or index funds, many of which track the same thing (Schwab industrial fund, JP industrial fund, Schwab pharmaceutical fund, JP pharmaceutical fund, etc.). So there’s an “echo chamber” in the market that causes any movement to appear greater than it is.

- I think all these derivatives, which are composed of multiple companies or even other funds probably, are what’s artificially propping up the stock market. The market should not be where it is right now, as I’ve said before. The recent reporting that the total valuation of the stock market has surpassed the U.S. GDP I think confirms this. Another crash/recession is likely, just a matter of when.