As I manually gather more data for my program to digest, I come across some interesting bits that I hope will help me either be a smarter trader overall, or help me come up with new ideas to put into the program. For now, though, it’s just interesting information that fill up my brain with.

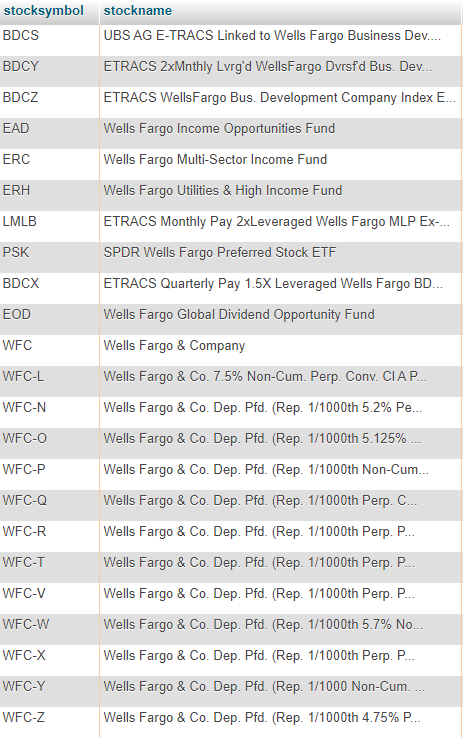

As you can see in the accompanying graphic… there’s a LOT of Wells Fargo notes. There are various banks and brokerages that have dozens of notes and funds, but Wells Fargo by far takes the cake. It just seems odd to me that a bank currently mired in bad publicity and consumer sentiment, is swimming in preferred stock. I have no idea when these were issued, however, but I doubt they were all issued before Wells Fargo got busted for ripping off their customers.

As you can see in the accompanying graphic… there’s a LOT of Wells Fargo notes. There are various banks and brokerages that have dozens of notes and funds, but Wells Fargo by far takes the cake. It just seems odd to me that a bank currently mired in bad publicity and consumer sentiment, is swimming in preferred stock. I have no idea when these were issued, however, but I doubt they were all issued before Wells Fargo got busted for ripping off their customers.

Another company swimming in preferred stock, much to my surprise, is Public Storage. They have a whopping 14 sets of stock. Now I know companies sometimes issue notes or preferred stock to fund projects, such as expanding into new services, developing new buildings, etc. But if that’s the play here, that they keep issuing more stock in order to fund more rental facilities, you have to wonder if the existing facilities are making any money, and/or how solid the company itself is. Same for Wells Fargo.

Other interesting things I’ve come across:

- There’s a company called Kesselrun Resources. Two guesses what the founders’ favorite movie is.

- It dawned on me to wonder how it works that there are publicly-traded marijuana companies out there. I mean, marijuana is still federally-illegal, so how are these companies trading on public exchanges, AND filing federal paperwork? Are they in danger of being taken down by feds? Also how are they large enough to trade on exchanges, are they conducting national sales? Wouldn’t that be a violation of federal mailing laws, shipping drugs across state lines?

- There’s a TON of financial and pharmaceutical companies out there, and these are just the ones publicly-traded, I’m sure there are many more that are privately-held. I’m planning on creating some pie charts in my next post to show a breakdown of sectors by market, it ought to be interesting to see what the U.S. stock markets are actually composed of (one thing to keep in mind is that the financial sector is HEAVILY skewed as there are tons upon tons of funds in that sector, rather than just companies).